&l;p class=&q;tweet_line&q;&g;When Tony Mitchell, one of my managers, said he would never touch Tesla or Intuit, it caught my attention. Over the 18+ years I&s;ve watched Tony, his 17.15% return is nearly triple that of the S&a;amp;P 500&s;s 5.79%. When someone with a track record like that disagrees with me, I pay attention.

&l;strong&g;Ken Kam&l;/strong&g;: You don&s;t own any Tesla and never have, yet you seem to have a strong opinion?

&l;strong&g;Tony Mitchell&l;/strong&g;: I have never owned Tesla and I don&a;rsquo;t anticipate owning it at any time in the near future. Tesla is what I consider a &a;ldquo;don&a;rsquo;t touch&a;rdquo; stock.

&l;strong&g;Kam&l;/strong&g;: Can you explain what is a &a;ldquo;don&a;rsquo;t touch&a;rdquo; stock?

&l;strong&g;Mitchell&l;/strong&g;: Sure. In the case of Tesla, here are the items that really stand out to me.

&l;em&g;Product&l;/em&g; &a;ndash; I have some friends that drive a Model S and they love it. I think they did a good job with the Model S and I&a;rsquo;ve heard mostly all positive feedback on the Model S. The only problem with the Model S is that it is not affordable for most with its starting price at $65,000.

If the Model 3 is the affordable model that is needed for the longevity of the company, I have serious concerns. I don&a;rsquo;t think the exterior is that exciting and the first thought I had when I saw the interior was that it was &a;ldquo;a well-upholstered Soap Box Derby Car with a tablet on the middle of the dashboard&a;rdquo;. I don&a;rsquo;t see the appeal of the Model 3. The Model T was more exciting when Henry Ford rolled it out!

&l;em&g;The Consumer Experience&l;/em&g; &a;ndash; Tesla has a cult of followers, and for that reason, I may not ever short the stock. It amazes me how many people defend Elon Musk, Tesla&s;s CEO, as the greatest thing since sliced bread. There is a fine line between genius and craziness.

Overall, the consumer experience has been mostly positive thus far, but I see many red flags. If Musk did not admit his mistake of wanting to close all the showrooms, it may have been lights out for the company.

&l;em&g;Sales Trends / Growth Rates&l;/em&g; &a;ndash; This has had its moments, concerns, and is still yet to be decided.

&l;em&g;Sustainability&l;/em&g; &a;ndash; The auto business is a tough business, is highly regulated, often sued, and has seen many great cars with modern innovation whose leaders failed to keep the company operating.

If you Google Defunct Auto companies, you&a;rsquo;ll find a list of over 1,200 companies &a;ndash; that is more than 10 a year that failed for the last 120 years! Some of these cars were just as futuristic as the Tesla &a;ndash; like the DeLorean or the Tucker.

If you think Tesla is different because it is electric, the list of names include many companies that were building electric cars years ago such as Detroit Electric (1907&a;ndash;1939), Century Electric (1911&a;ndash;1915), Baker Electric (1899&a;ndash;1916), Armstrong Electric (1885&a;ndash;1902) and many more!

&l;em&g;Management&l;/em&g; &a;ndash; A great leader realizes that his people are important assets of the company and in many cases, are the most important asset of the company. The turnover of top employees at Tesla is another red flag and combined with stories that I&a;rsquo;ve read about how employees are treated at Tesla, Musk isn&a;rsquo;t scoring any points in leadership. Add in Musk&s;s issues with the SEC, and I can&a;rsquo;t count on the Management in this company.

I&a;rsquo;m not saying that it isn&a;rsquo;t possible for Musk to get it right in the long run, as he certainly is very intelligent. But intelligence is not a guarantee of business success as there are many other factors that determine the success of a business.

&l;em&g;Price-To-Earnings Ratio&l;/em&g; &a;ndash; With the above issues, this would have to be the best value in the neighborhood to even consider an investment, and it is hardly close.

&l;em&g;Balance Sheet/Cash Flow&l;/em&g; - These are so closely related in this case and both such a big question mark. It is unclear whether or not the cash flow will be enough to sustain the company or if Tesla will need to raise cash. If it does need to raise cash, the current stockholders will certainly become diluted &a;ndash; just how much is the question.

&l;strong&g;Kam&l;/strong&g;: It sounds like you don&a;rsquo;t see any upside in Tesla &a;ndash; do you?

&l;strong&g;Mitchell&l;/strong&g;: Not really &a;ndash; I would say there is definitely more risk to the downside and it could fall hard, but with a momentum stock like this that has the almost cult following that it does, it could see some upside and that is why I put a stock like this on my &a;ldquo;Don&a;rsquo;t Touch&a;rdquo; list.

&l;img class=&q;dam-image ap size-large wp-image-7f23e542e9fa48928c48ad90082c04f1&q; src=&q;https://specials-images.forbesimg.com/dam/imageserve/7f23e542e9fa48928c48ad90082c04f1/960x0.jpg?fit=scale&q; data-height=&q;640&q; data-width=&q;960&q;&g; CEO of Intuit, Sasan Goodarzi

&l;strong&g;Kam&l;/strong&g;: Why does Intuit belong on your &a;ldquo;Don&a;rsquo;t Touch&a;rdquo; list?

&l;strong&g;Mitchell&l;/strong&g;: I believe that the valuation of Intuit is extremely high, trading at 53 times trailing earnings and I don&a;rsquo;t believe that it is sustainable. Here are the big rocks that stick out for me with Intuit.

&l;em&g;Product or Service&l;/em&g; &a;ndash; Intuit has had some great products for business accounting and tax preparation, however, their online version of QuickBooks is not up to par and pales in comparison to its much older desktop versions of QuickBooks. They know it and admit it freely &a;ndash; if you upgrade to the online version, they tell you to use both versions for a period of time to make sure that the online version works for you.

&l;em&g;The Consumer Experience&l;/em&g; &a;ndash; If the above statement doesn&a;rsquo;t scare you enough, I have a friend who has used the desktop version, their Intuit Payroll services, and upgraded to QuickBooks online. He was happy with the first two services until he upgraded to the online version of QuickBooks and it was nothing but a headache for him since. He was being double billed, he couldn&a;rsquo;t get the payroll service to work with online QuickBooks, and worse of all, he called many times and he couldn&a;rsquo;t get the help that he needed to fix it for months.

&l;em&g;Management&l;/em&g; &a;ndash; My friend eventually had someone reach out to him and help him, but it took weeks after sending priority letters to the CEO and President of Intuit. Even then after everything was finally worked out, a month later he experienced another billing issue. Much of his problems started because of a salesperson that mislead him. But what made it worse for him was that nobody at Intuit would believe him until the office of the President assigned someone to fix his issues.

It isn&a;rsquo;t always easy to evaluate how good management is, as information on the actual behaviors of management is generally limited. But the failure to correct customers&s; issues is a behavior of management that should be accounted for and I believe that it will be reflected at some point in the price of their stock.

&l;em&g;Price-To-Earnings Ratio&l;/em&g; &a;ndash; With Earnings projected to grow 12.5% and Revenues 14%, a PE of 53 times trailing earnings is not justified.

&l;strong&g;Kam&l;/strong&g;: If you owned Intuit would you be a seller?

&l;strong&g;Mitchell&l;/strong&g;: Yes, but I don&a;rsquo;t own it, so it is just a &a;ldquo;Don&a;rsquo;t Touch&a;rdquo; stock for me. If they improve the quality of their products and improve their customer service experience, they may be okay, but right now with the high PE, I see much more downside risk than upside potential.

&l;strong&g;My Take&l;/strong&g;: Tony told us &l;a href=&q;https://www.forbes.com/sites/kenkam/2017/03/27/top-internet-fund-manager-tony-mitchell-is-staying-away-from-snap/&q;&g;not to touch Snap&l;/a&g; in March 2017 when it was at $23. That was a great call as Snap traded as low as $5 in 2018 and closed&a;nbsp;today at $11.

My managers don&s;t always agree with each other. Hashing out investment ideas with other great investors helps all of my managers to improve. If you can&s;t have a discussion with someone with whom you disagree, you should not be an investor.

While I&s;ve heard from many who disagree with me on Tesla, I have a lot of respect for Tony&a;rsquo;s views because of his track record.

Tony Mitchell&s;s Internet Fund has an 18+ year track record that extends through 2 market crashes, numerous corrections, and sector rotations. Over that period, Tony averaged 17,15% a year which compares well to the S&a;amp;P 500&s;s 5.79% return for the same period. Over the last 15 &a;amp; 10 year periods, Tony&a;rsquo;s fund did better than the top U.S. equity mutual fund manager in Morningstar&s;s database. Tony&s;s portfolio is up 21% this year, almost double that of the S&a;amp;P&a;rsquo;s 11.7% through Friday.

To be notified when Tony updates his views, &l;a href=&q;https://paths.marketocracy.com/lists/?p=subscribe&a;amp;id=423&q; target=&q;_blank&q;&g;click here&l;/a&g;. To be notified when I write about specific stocks my managers cover, &l;a href=&q;https://paths.marketocracy.com/lists/?p=subscribe&a;amp;id=1&q; target=&q;_blank&q;&g;click here&l;/a&g;.&l;/p&g;

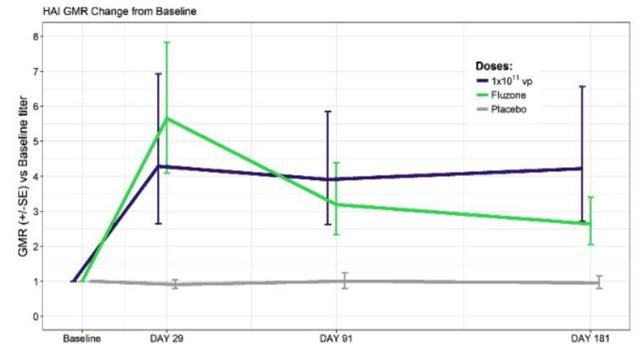

Figure 3: T-Cell Response (Source ALT)

Figure 3: T-Cell Response (Source ALT)

Oil-Dri Co. of America (NYSE:ODC) declared a quarterly dividend on Wednesday, March 13th, Wall Street Journal reports. Shareholders of record on Friday, May 17th will be given a dividend of 0.24 per share by the specialty chemicals company on Friday, May 31st. This represents a $0.96 dividend on an annualized basis and a yield of 3.32%. The ex-dividend date is Thursday, May 16th.

Oil-Dri Co. of America (NYSE:ODC) declared a quarterly dividend on Wednesday, March 13th, Wall Street Journal reports. Shareholders of record on Friday, May 17th will be given a dividend of 0.24 per share by the specialty chemicals company on Friday, May 31st. This represents a $0.96 dividend on an annualized basis and a yield of 3.32%. The ex-dividend date is Thursday, May 16th.

Global Medical REIT (NYSE:GMRE) was downgraded by Zacks Investment Research from a “buy” rating to a “hold” rating in a research note issued on Tuesday.

Global Medical REIT (NYSE:GMRE) was downgraded by Zacks Investment Research from a “buy” rating to a “hold” rating in a research note issued on Tuesday.

Robeco Institutional Asset Management B.V. cut its holdings in shares of Jabil Inc (NYSE:JBL) by 13.4% in the 4th quarter, Holdings Channel reports. The firm owned 161,796 shares of the technology company’s stock after selling 24,970 shares during the quarter. Robeco Institutional Asset Management B.V.’s holdings in Jabil were worth $3,999,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Robeco Institutional Asset Management B.V. cut its holdings in shares of Jabil Inc (NYSE:JBL) by 13.4% in the 4th quarter, Holdings Channel reports. The firm owned 161,796 shares of the technology company’s stock after selling 24,970 shares during the quarter. Robeco Institutional Asset Management B.V.’s holdings in Jabil were worth $3,999,000 as of its most recent filing with the Securities and Exchange Commission (SEC).