Altimmune (ALT) recently announced additional positive data from their NasoVAX Phase II extension study that claimed that 100% of the reported subjects remained seroprotected over a year after vaccination. In addition, their seroconversion rate was unaffected beyond one year after vaccination. The new data came from subjects that were administered the highest NasoVAX dose. Out of fifteen subjects, eight returned to the study with an average of 13.5 months after vaccination. These subjects exhibited an impressive median hemagglutination inhibition "HAI" titer in excess of 3x higher than conventional seroprotective levels. What is more, they continued to present impressive mucosal antibody and T-cell measurements of immunoprotection revealed in earlier studies. The company believes that "NasoVAX is well positioned to compete with other influenza vaccines currently under development."

Company OverviewAltimmune is an immunotherapeutic biotech company employing two innovative therapeutic delivery platforms, RespirVec and Densigen. Altimmune has the capacity to design and cultivate products projected to target a broad range of disease indications comprising of acute respiratory infections, chronic viral infections, and cancer. In the end, Altimmune plans to generate products that have distinctive benefits over contemporary products.

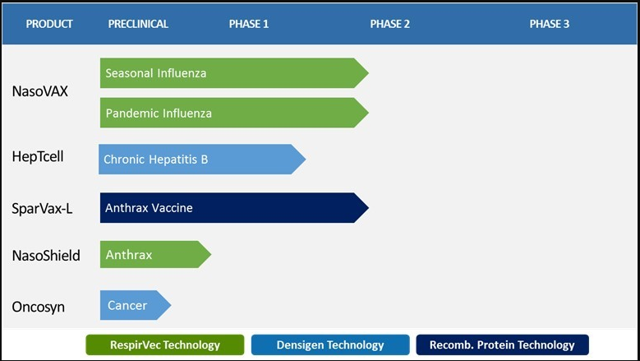

PipelineNasoVAX is the flagship of the company's pipeline and the flagbearer of the RespirVec platform. NasoVAX is an intranasally administered influenza vaccine that contains an adenovector to enhance the influenza antigen inside a cell, as a result, boosting the systemic and rapid immune response matched against the current influenza vaccines.

HepTcell is an immunotherapy product candidate being developed for patients who are chronically infected with the hepatitis B virus "HBV". HepTcell's aim is to offer a "functional cure" for HPV, which would require eradication of hepatitis B surface antigen "HBsAg" in a patient's blood.

SparVax-L is being developed as a two-dose anthrax vaccine that is being supported by the National Institute of Allergy and Infectious Diseases. Although this anthrax candidate doesn't get the publicity as NasoShield, it is still in the clinic and has the potential for government contracts if approved.

Furthermore, the company has been developing a different Anthrax vaccine named NasoShield, intended to be a first-in-class product that can deliver rapid and stable protection after only one intranasal administration.

The company's pre-clinical program, Oncosyn, is an immunotherapeutic product candidate that is being designed to be used in combination with immune checkpoint inhibitors for superior antitumor properties. This is the company's latest addition to the pipeline and first attempt to enter the oncology arena.

Figure 1: Altimmune Pipeline (Source ALT)

Altimmune's latest addition is ALT-702, a TLR7/8 agonist conjugate adjuvant that the company expects to safely produce or increase immune responses in an assortment of therapeutic settings. Adjuvants can be a useful tool to have for a company looking to modulate the immune system. Having ALT-702 allows the company to have multiple options in formulating a vaccine without needing to license another company's adjuvant.

Why Is This New Data Important?The recent data is a noteworthy update for investors due to NasoVAX continuing to display superb results in clinical trials. Out of all of Altimmune's potential product candidates, I that believe that NasoVAX has the greatest potential to make it through the regulatory process and disrupt the flu vaccine market. In my previous Altimmune articles, I have stressed the importance of NasoVAX to remain unblemished through all clinical trials in order to find a seat at the table of elite flu vaccines. Historically, this is not an easy goal to accomplish for most therapeutics. In fact, it is common for therapeutics to demonstrate amazing results in their pre-clinical development and initial clinical trials; but they often lose that perfection as they progress through the regulatory process and are tested in larger trials. NasoVAX has yet to display any disintegration in their clinical trial numbers and this latest data is another tally in the win column.

Looking for a PartnerAnother vital piece of information in the press releases was CEO Vipin Garg's declaration that the company intends to find a partner for NasoVAX's development and commercialization. This news should be welcomed by investors because of the potential for compensation, as well as the benefits of being partnered with an experienced commercial-staged company.

The next concern is the details of the potential partnership and how the market will react to the news. I will find the greatest value in who the partner is over any other detail. The flu vaccine market is dominated by a small group of juggernaut big pharmaceutical companies, which include Sanofi (SNY), GlaxoSmithKline (GSK), and CSL. Any mention of these companies being a potential partner would be a monumental catalyst for the stock. Having a big pharma would validate the legitimacy of Altimmune and NasoVAX, which bolster investor sentiment as long as NasoVAX progress through regulatory actions with a name brand company holding its hand. On the other hand, if the partner is not a highly recognized vaccine company, we can expect a weaker response from the market and the need for finer details.

Other major details to be analyzed would be the payment size and structure. Altimmune can benefit from a substantial upfront payment, as well as milestone payments to reinforce the bank account. Another detail to look for would be if the partnership is just a U.S. partnership or a possible global partnership. The flu is a global public health concern and is continually mutating as it spreads from one population to the next; so, I wouldn't be surprised if NasoVAX's partnership is for global rights. Not only would this entail a larger payment/s but could also require the partner to pay for the regulatory process in other regulatory jurisdictions.

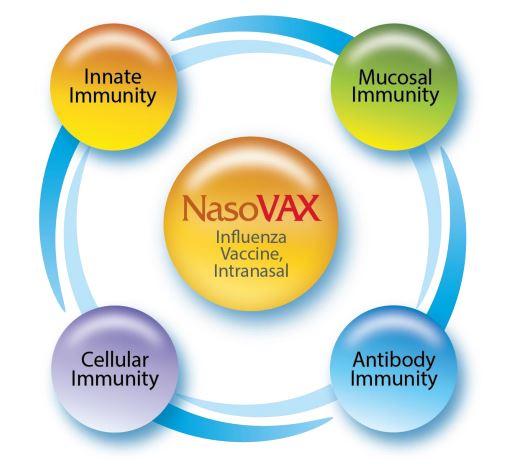

How is NasoVAX Doing It?NasoVAX is an intranasally administered rAd influenza vaccine that generates the expression of the influenza antigen in the body. This goal of this action is to stimulate a comprehensive and prompt immune response compared to traditional influenza vaccines.

Source

This combination of serum antibody, mucosal antibody, and T-cell responses improves the body's capability to thwart infection and advocates that NasoVAX could have a superior impact on flu symptoms and purging of the flu virus than currently approved influenza vaccines.

This recent data was acquired from subjects that returned for analysis exhibited adequate seroprotective levels for at least 13 months. It is not typical for an influenza vaccine to have durable responses over one year and advocates that immune response prompted by NasoVAX could be defensive beyond the present influenza vaccines.

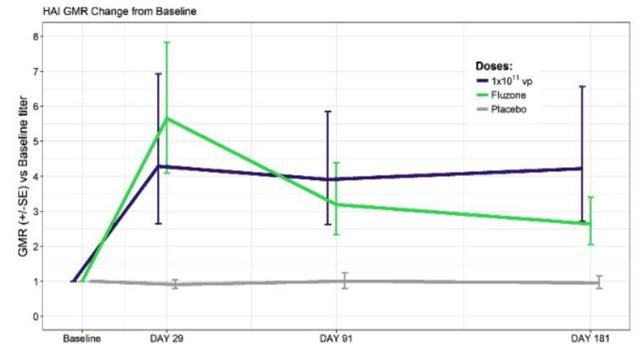

However, this latest data is confirming NasoVAX is still demonstrating similar measurements from previous readouts. I have inserted company graphs that display these previous data points in comparison with Fluzone.

Figure 2: Antibodies Measured Over Time (Source ALT)

Looking at figure 2, we can see that NasoVAX (Dark Blue Line) outperforms Fluzone (Green Line) in terms of the number of antibodies beyond 91 days. This is important due to the flu season lasting over 5 months.

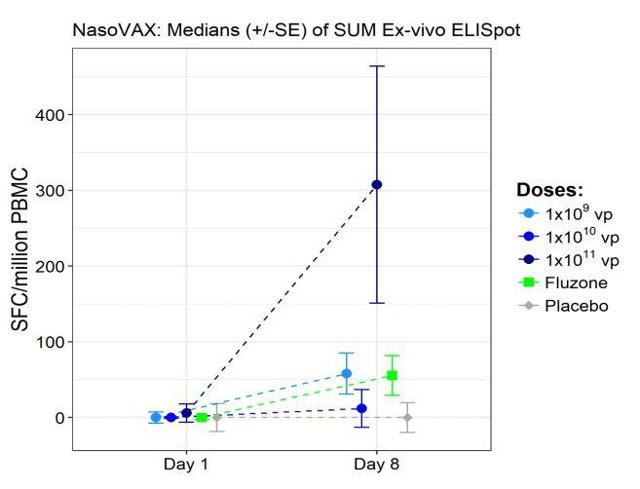

Figure 3: T-Cell Response (Source ALT)

Figure 3: T-Cell Response (Source ALT)

Figure 3, shows how the higher dose NasoVAX stimulates a stronger T-Cell response compared to Fluzone by day 8. According to Altimmune, having a robust T-Cell response helps defend against genetic drift and shift that can occur in the influenza virus.

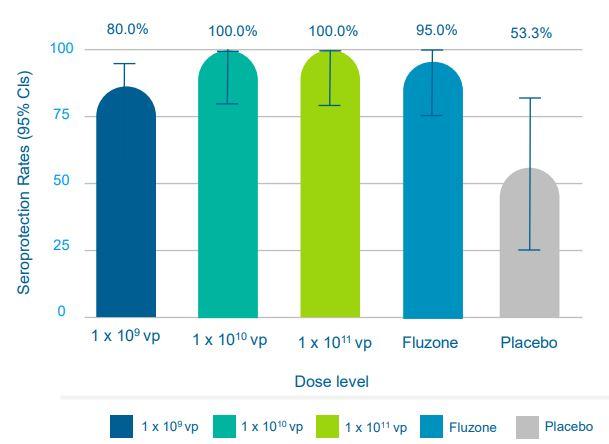

Figure 4: Seroprotection Rates (Source ALT)

Figure 4, shows how the NasoVAX outperforms Fluzone in seroprotection rates, which indicates a NasoVAX vaccinated subject's antibody response is greater than a Fluzone vaccinated subject's antibody response.

NasoVAX outperforms Fluzone in all these measurements, which points toward an improved influenza vaccine. As long as NasoVAX continues to outperform Fluzone through the regulatory process, investors should expect NasoVAX to accrue a market interest as a potential flu vaccine disruptor.

Changing Focus?The new pipeline candidate Oncosyn and proposed acquisitions appear to be moving away from vaccines and more towards other therapeutics. Remember, Garg stated in the recent press release,

"We are currently engaged in a rigorous acquisition review process focused on novel immunotherapeutic approaches for cancer, including immunostimulants and oncolytic viruses, and innovative product candidates for liver diseases. The proceeds from our recent successful financing efforts have put us in a strong position to execute our acquisition plans."

Moving away from the prophylactic infectious disease vaccines does trigger some red flags for me. The company has been progressing their flu and anthrax vaccines through the regulatory processes…now the company wants to add oncology and hepatology to the mix?

I agree that immunoncology and NASH are hot topics in the biotech arena. But, why should a small-cap biotech decide to start down a road that could cost hundreds of millions of dollars to get those products to the market? Although I do like to see the R&D department working at full-bore; I also like to see at least one product candidate cross the FDA finish line before the company starts dividing its attention to other Performing some pre-clinical work is acceptable but I always become apprehensive when a company decides roll-out a whole new arm of the pipeline before fully establishing their flagship products. The amount of time and expenses that will be needed to initiate clinical trials could be used to fund operations.

What would I like to see? I would like to see the company nail down a source of revenue and work with the platforms they have. In my first Altimmune article, I had a section that outlined my wish list for Altimmune's expanded use of the RespirVec platform.

"I do see ALT to be a long-term hold if management is able to close some deals and collaborations. I am very intrigued to see what other vaccines can be generated with the RespirVec platform. Studies have shown that other diseases can be vaccinated with a rAd nasal vaccine. Some of these include:

Tetanus Ebola Respiratory Syncytial Virus (RSV) Botulism HIV MalariaI still believe the company should push forward with RespirVec and possible address these notorious illnesses listed above. Alternatively, the company could find other infectious viruses to address such as hand, foot, and mouth disease, or rotavirus; both of which carry a high degree of morbidity and mortality to young children worldwide.

If the company can prove that NasoVAX works and that the same platform technology works with other vaccines…don't you expect big pharma to start finding ways to collaborate/partner with Altimmune?

My general view of this is…prove to me that you can get your flagship product to the market before trying to tackle what other multi-billion companies are attempting to accomplish.

FinancialsThe company has been focusing a lot of its efforts on securing funding to feed the expanding pipeline and have enough ammo to complete its expected pipeline acquisitions.

Back On March 8th, the company revealed they had roughly $34.4M in cash, cash equivalents at the end of 2018. With the recent offering pulling in $12.7M, the company has a significant amount of cash, which Garg intends to utilize some of these funds to acquire new product candidates. This is where my concern about expanding the pipeline comes into play. How much is the company going to be allocated to acquiring candidates? How much is going to be used in the direction of current pipeline candidates? What are the operating expenses going to be after these acquisitions?

Without these details, it is hard to estimate where the company will be at the end of 2019. That hefty bank account could be cut down in a short period of time with a few purchases and an increased cash burn rate to progress the new pipeline.

What is Next?The company has announced it will be releasing its Q4/2018 earnings report and hosting a conference call on April 2nd. Not only will investors get see the better-quality financial details of the company, but I also expect analysts to inquire about the proposed NasoVAX partnership and the expected acquisitions.

Another event to note is the upcoming International Liver Congress on April 12, where the company will present HepTcell Phase I clinical trial data. Hopefully, this presentation will contain updated data for HepTcell that should provide a clearer picture of HepTcell's efficacy. Previously, the company had trouble comprehending the data due to the results of the treated subjects were not prominently different than placebo controls. This required the company to evaluate the two-dose levels of HepTcell and need for the TLR-9 agonist adjuvant. Both of these doses displayed tolerability and was able to hit the primary endpoint of safety. In addition, Altimmune announced elevated baseline-adjusted immune response levels and responder rate in the two adjuvanted HepTcell dose groups in comparison to the placebo group.

Altimmune believes that the analysis of the data delivered enough evidence to move HepTcell into Phase II trials. Perhaps this upcoming presentation will provide investors with more encouraging data and we can see a resurgence in the share price due to Altimmune potentially having a functional cure for HBV.

ConclusionNasoVAX continues to impress and the company is now looking for potential partners to get it through the rest of the FDA process and onto the market. If Garg can secure a brand name partner for NasoVAX, the company would be granted instant credibility and would be a transformative development for NasoVAX as it moves forward with proper support. In addition, investors should expect a metamorphic change in the stock as the biotech sector begins to discover ALT as a legitimate stock to invest in. At the moment, ALT's market cap is around $20M which I believe is drastically undervalued considering the company has roughly $47M in funds. In addition, the company's current cash per share is about 3.5, which we can expect Garg to deploy in order to acquire new pipeline candidates.

This is where Garg can make or break 2019…if Garg can secure a strong U.S or global partner for NasoVAX with a beneficial payment structure, we could see the company's current cash position sustain the company long enough to get NasoVAX through the regulatory process and to launch. This would provide the company with a sustained source of revenue and hopefully prevent heavy shareholder dilution in the coming years. On the other hand, Garg could start writing checks and acquiring pipeline candidates before having a NasoVAX partner deal signed. I would find this extremely disappointing because this would mean NasoVAX would most likely have to wait for a partnership deal to move forward into Phase III, or Altimmune would have to fully-fund the Phase III. If the company does have to move into phase III without a development partner, we can expect another offering at some point in the future. Of course, other possible scenarios can transpire but the two above are more definitive and should create some volatility in the stock.

Personally, I have gained some confidence in Garg and hope to see if he can get the NasoVAX partnership finalized before they begin Phase III and before the bank account requires another offering. If Garg can secure a brand name partner before the end of Q2, I will look to add to my evolving position. However, if Garg fails to secure a partner in that time, I will refrain from adding until there is a clear strategy for NasoVAX and the cash runway can be estimated with detailed information.

2019 is shaping up to be a pivotal year for my ALT investment as the company's lead product moves closer to FDA approval, yet, the company is starting looking to take their pipeline in another direction. I believe Altimmune already has an impressive pipeline that needs to be pushed to the limit before looking elsewhere. Unless the company has identified some great opportunities, I would rather see the current pipeline products have the support needed to get to the finishing line before the company takes a gamble unproven products or platforms. Despite the potential for a promising NasoVAX partnership, I have to be critical of Garg's choices for acquisitions and weigh my options. I invested in ALT because of NasoVAX and their current pipeline...if Garg decides to turn Altimmune into a money pit "cancer vaccine" company, I will liquidate my position upon the news release.

Disclosure: I am/we are long ALT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

No comments:

Post a Comment